Some Of Paul B Insurance Medicare Agency Huntington

An Unbiased View of Paul B Insurance Medicare Agent Huntington

Table of ContentsThe Paul B Insurance Medicare Advantage Plans Huntington IdeasPaul B Insurance Insurance Agent For Medicare Huntington - An OverviewPaul B Insurance Insurance Agent For Medicare Huntington - The Facts9 Easy Facts About Paul B Insurance Medicare Supplement Agent Huntington ExplainedNot known Details About Paul B Insurance Medicare Agent Huntington

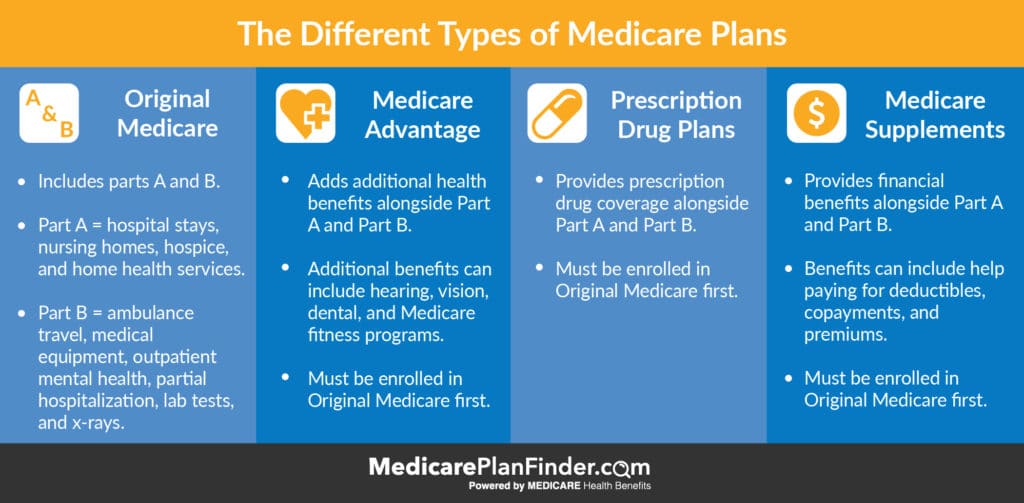

Many Medicare Benefit plans deal additional benefits for oral care. Several Medicare Advantage intends offer additional benefits for hearing-related solutions. You can get a different Component D Medicare drug strategy. It is rare for a Medicare Benefit plan to not consist of drug coverage. You can have dual coverage with Original Medicare and also other protection, such as TRICARE, Medigap, veteran's benefits, company strategies, Medicaid, etc.But you can have various other twin protection with Medicaid or Unique Demands Plans (SNPs).

Medicare wellness strategies offer Part A (Healthcare Facility Insurance) as well as Component B (Medical Insurance) benefits to people with Medicare. These plans are typically offered by exclusive business that agreement with Medicare. They consist of Medicare Benefit Program (Component C) , Medicare Price Strategies , Presentations / Pilots, and also Program of All-inclusive Take Care Of the Elderly (PACE) .

Medicare is the government medical insurance program for individuals 65 or older, and also individuals of any type of age with particular handicaps.

The Ultimate Guide To Paul B Insurance Insurance Agent For Medicare Huntington

They cover everything Initial Medicare does and also a lot more, in some cases including additional advantages that can save you cash as well as help you remain healthy. There are fairly a few misconceptions about Medicare Benefit plans.

It covers some or all of what Original Medicare doesn't pay, however it does not come with bonus. You can not enroll in both a Medicare Advantage as well as Medication, Supp strategy, so it's important to understand the similarities as well as distinctions in between the 2.

They're crucial to believe about, since Original Medicare as well as Medicare Supplement Plans do not cover prescription medications. PDP protection is consisted of with several Medicare Advantage Plans.

Brad as well as his better half, Meme, know the value of great service with great advantages. They selected UPMC permanently due to the fact that they desired the entire plan. From doctors' check outs to dental protection to our acclaimed * Healthcare Concierge team, Brad and Meme understand they're getting the care as well as solutions they require with every phone call as well as every see.

The 9-Minute Rule for Paul B Insurance Medicare Health Advantage Huntington

An FFS option that allows you to see clinical providers that minimize their charges to the strategy; you pay less cash out-of-pocket when you make use of a PPO company. When you go to a PPO you usually will not need to file cases or documentation. Nonetheless, mosting likely to a PPO medical facility does not assure PPO advantages for all services got within that hospital.

Many networks are fairly large, but they might not have all the physicians or hospitals you desire. This method typically will conserve you money. Normally enrolling in a FFS strategy does not assure that a PPO will be readily available in your area. PPOs have a stronger visibility in some areas than others, and in areas where there are local PPOs, the company website non-PPO advantage is the conventional advantage - paul b insurance Medicare Part D huntington.

Your PCP gives your basic clinical treatment. In many HMOs, you must get authorization or a "reference" from your PCP to see various other carriers. The reference is a suggestion by your medical professional for you to be examined and/or treated by a different medical professional or doctor. The recommendation guarantees that you see the right service provider for the treatment most proper to your condition.

Not known Facts About Paul B Insurance Medicare Agent Huntington

A Health and wellness Financial savings Account enables individuals to spend for current wellness expenses and conserve for future competent clinical costs on a pretax basis. Funds deposited right into an HSA are not taxed, the equilibrium in the HSA grows tax-free, which amount is offered on a tax-free basis to pay medical costs.

Medicare beneficiaries pay nothing for a lot of preventative services if the services are gotten from a physician or other health and wellness care supplier that gets involved with Medicare (additionally Bonuses called approving task). For some precautionary services, the Medicare beneficiary pays nothing for the solution, yet might need to pay coinsurance for the office see to get these services.

The Welcome to Medicare physical examination is a single evaluation of your health, education and learning as well as therapy concerning preventive solutions, and references for other treatment if needed. Medicare will certainly cover this exam if you obtain it within the first one year of registering partly B. You will certainly pay absolutely nothing for the exam if the medical professional accepts job.

What Does Paul B Insurance Medicare Agency Huntington Mean?

On or after January 1, 2020, insurers are required to use either Strategy D or G along with An and also B. The MACRA changes likewise developed a new high-deductible Plan more info here G that might be offered starting January 1, 2020. For additional information on Medicare supplement insurance plan design/benefits, please see the Advantage Graph of Medicare Supplement Program.

Insurance companies might not deny the applicant a Medigap plan or make any type of costs rate distinctions as a result of health and wellness condition, asserts experience, medical condition or whether the applicant is getting wellness care services. Nevertheless, qualification for plans used on a team basis is restricted to those individuals who are members of the group to which the plan is released.